tax saver plan benefit card

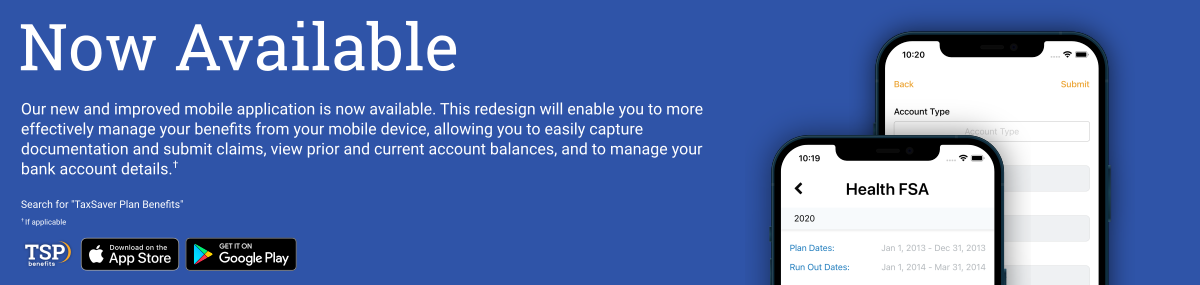

The TaxSaver Plan Mobile App is the easiest way to manage your Dependent Care Health FSA Transit Parking and HRA accounts on the go. 1601 Trapelo Road Main Building Suite 301.

Employers that do offer the card may choose to pass on the expense of the card to the participant.

. Some unions may be eligible to elect the 10000 benefit. Download TaxSaver Plan Benefits and enjoy it on your iPhone iPad and iPod touch. Your satisfaction is our success.

Any claim received after 300 pm is considered to be received the following business day. TaxSaver Plan offers a wide array of Reimbursement Account Administration Services including Flexible Spending Accounts Health Reimbursement Arrangements Commuter Benefit Accounts Business Expense Reimbursement Accounts Wellness Reimbursement Accounts and Custom Reimbursement Accounts. The IU Benefit Card can be used to pay for IRS-defined eligible healthcare expenses.

To view your coverage policy document select the size of your employer group then the plan name listed at the top. Its time to transform your benefits administration and what it means for your business. You can view your account balances and transactions.

TaxSaver Plan HSA App provides the following functionality with its initial release Account balances and details. The TaxSaver Plan Mobile App is the easiest way to manage your Dependent Care Health FSA Transit Parking and HRA accounts on the go. Companies can save up to 1075 in PRSI while employees can save between 31 - 52.

We pay close attention to the particular needs and policies associated with each of our clients plans and we make a concerted effort to arrange our systems to boost efficiency as. Premium Only Plan Eligible employees may tax shelter insurance premiums for medical dental vision and life insurance offered through the Office of Group Benefits with the exception of the dependent life. Before you can open a Health Savings Account you must first be insured with a qualified High Deductible Health Plan HDHP.

Comprehensive administration compliance and management services. Benefits Card Mobile App MyCash Texting. The TaxSaver Plan HSA App provides information to those enrolled in a HSA managed by TaxSaver Plan.

Update your Direct Deposit information. The Debit Card is an option for your Employer to offer as a part of their Plan. Simplified efficient dependable benefits administration.

2 Homepage Taxaver Hsa Account Taxsaver Plan Your Satisfaction Is Our Success Taxsaver Plan Taxsaverplan Twitter. Each card will have a different number for. Increased tax savings and reduced health insurance costs.

TaxSaver Plan provides HSA solutions that include. The Taxsaver scheme has proved to be a huge success with over 6000 companies now purchasing Monthly Part yearly Bus Éireann only and Annual tickets for their employees. The Tax Saver Flexible Benefits Plan provides eligible employees the choice of participating in one or more of the options listed below.

Incurred is defined as when the service is rendered not when it is paid. Taxsaver Plan must verify that the dates of service have occurred during the plan year. In addition we take pride in our ability.

Ask us how we can customize a plan for you. You must enroll in basic life insurance if you wish to enroll in a City health insurance plan. Parking and Transit plans are separate plans and therefore each plan requires a separate election.

Mobile and web portals with anytime-access to account information. Blue Cross Blue Shield of Massachusetts provides a Summary of Benefits and Coverage SBC with online access to the corresponding coverage policy to all of our fully insured members and accounts. Over 15 million American families carry our health spending debit cards.

Self-only coverage 3600 3650. Family coverage 7200 7300. The TaxSaver Plan HSA App provides information to those enrolled in a HSA managed by TaxSaver Plan.

Healthcare FSA and HSA of this FAQ for details. The basic life insurance is a 5000 group term policy. 2022 TaxSaver Plan.

Summary of benefits and coverage. Formerly known as Tax Saver Benefit TSB Flexible Spending Accounts FSAs offer a convenient way for you to pay for IRS eligible healthcare andor dependent care expenses with pre-tax dollars. The cost for this benefit is.

TaxSaver Plan HSA App provides the following functionality with its initial release Account balances and details. The guidelines for contribution maximums are shown below. Flexible Spending Accounts FSAs TaxSaver Plan makes it easy for employers to offer Flexible Spending Accounts FSA by helping to reduce insurance costs and add depth to employee benefits.

Members may access their HSA Account balance make individual deposits into their HSA and manage overall account details via the App. Review the full list of eligible healthcare expenses. If you are enrolled in both the Health Savings Account and the Healthcare HSA special rules apply to the IU Benefit Card.

How much can I contribute to my HSA. When you enroll in an FSA your contributions are made through pre-tax payroll deduction meaning they and are not subject to federal state local or FICA taxes. We pride ourselves on delivering a variety of Reimbursement.

TaxSaver Plan Your Satisfaction is our Success. A Section 125 Plan states that services must be incurred during the plan year. Please contact TaxSaver Plans CSR Department at 800-328-4337 for specific questions about your Employers Commuter Benefit Plan.

Not all Employers will choose to offer the card. Debit card transactions direct deposit reimbursement and electronic statements. You may receive 2 debit cards issued in the name of the participant.

Members may access their HSA Account balance make individual deposits into their HSA and manage overall account details via the App.

Tax Saver Landing Page Landing Page Landing Page Design Savers

Taxsaver Plan Your Satisfaction Is Our Success

Easy Saver Card Balance Savers Card Balance Savings Account

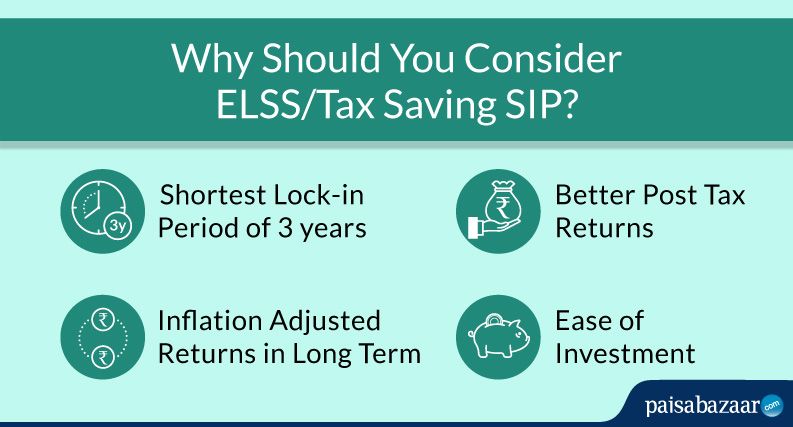

Best Tax Saving Sips 5 Top Sip Mutual Funds For 2020 Paisabazaar Com

4 Best Performing Tax Saving Elss Mutual Funds Fy 22 23

This Incredible Product Comes Jamloaded With These Amazing Benefits Affiliate Traffic Email Marketing Strategy Marketing Strategy

Taxsaver Explained For You Jj Kavanagh

Taxsaver Plan Your Satisfaction Is Our Success

Fixed Deposits Know How Tax Saver Fixed Deposits Work The Financial Express

Mirae Asset Tax Saver Funds To Invest Savers Investing Fund

Taxsaver Plan Your Satisfaction Is Our Success

This Incredible Product Comes Jamloaded With These Amazing Benefits Affiliate Traffic Email Marketing Strategy Marketing Strategy

Mirae Asset Tax Saver Fund Youtube

Save Tax Up To Rs 45 000 Invest In Mutual Fund Elss Advantages Of Mutualfund Elss Schemes Over Other Tax Saving In Finance Saving Investing Mutuals Funds

The Term Liquid Fund Is Given To The Scheme Because This Economic Term Is Used To Denote Cash In Hand The Investors Who Want Fund Mutuals Funds Economic Terms

Your Guide To Becoming The Ultimate Retirement Saver The Motley Fool Saving For Retirement Retirement Planning Social Security Benefits