working in nyc taxes

Property taxes are due either in two semi-annual payments for homes with assessed values of more than 250000 or four quarterly payments for homes with assessed. June 4 2019 935 PM.

How Much Tax Is Deducted From A Paycheck In Ny Cilenti Cooper Overtime Lawyers In Ny

Best of all you wont have to.

. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the. The only two NY cities that have a separate tax are Yonkers and NYC. Yes you will pay taxes in both states if you live in NJ and work in NYC but you wont be double-taxed as you will receive credits for taxes paid.

A single person making the Long Island median household income of 112365 would pay about 6170 per year in state income taxes. October 1 2021 The onset of. New York Tobacco Tax.

If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you. Withholding tax requirements Who must withhold personal income tax. Besides NY part-year return you also file NJ-1040 resident return and make sure to.

People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Notably sales tax in New York City is 8875 while in New Jersey the statewide retail sales tax is 6625. On the other hand many products face higher rates or additional charges.

Things to Watch Out For When Working in NYC But Living In NJ. Also in addition to state taxes New York City imposes a city tax on its. Yonkers taxes you if you live or work in Yonkers but NYC only taxes you.

For instance the sales tax in New York City is currently 8875 while the sales tax rate in New Jersey is 6625. Cigarettes are subject to an excise tax of 435 per pack of 20 and other. Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M.

New York Income Tax Rate. The tax is collected by the New York State Department of Taxation and. In Jersey City NJ the sales tax is only 33125.

If you live on Long Island but. You work for a New York company and New York taxes is withheld from your paychecks. There are eight tax brackets that vary based on income level and filing status.

These types of taxes are common in state-level sales taxes but not common at the federal level. New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax. New Yorks income tax rates.

There are four tax brackets starting at 3078 on taxable income. Wealthier individuals pay higher tax rates than lower-income individuals. Like the states tax system NYCs local tax rates are progressive and based on income level and filing status.

Solved I Live In Nj But Work In Ny How Do I Enter State Tax

Nj Ny Taxes Living In Nj Working In Nyc R Tax

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

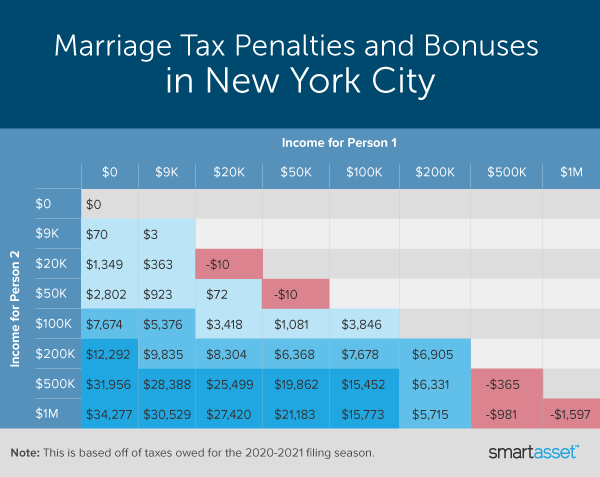

Marriage Penalty Vs Marriage Bonus How Taxes Work

Become An Nyc Free Tax Prep Volunteer

Comptroller Stringer Property Taxes Are Crushing Working New York Families Office Of The New York City Comptroller Brad Lander

Nyc Mansion Tax Pied A Terre Tax

New York Tax Rates Nyc S Richest Face Top Rate Of Over 50 Under Cuomo S Plan Bloomberg

State And Local Income And Sales Taxes In The 25 Biggest Us Cities

Tax Me If You Can The New Yorker

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation

N J Could Grab Hundreds Of Millions In N Y Income Taxes Paid By Nyc Employees Now Working At Home In Jersey Nj Com

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States

Tax Collections Plunge In Wake Of Stock Market Downswing The City

What Taxes Do You Pay If You Live In New York City Work In New Jersey Sapling

My Attempt At Nj Area Research To Move Working In Nyc Please Destroy It R Newjersey

Tythedesign Nyc Dept Consumer Affairs Promoting Free Tax Preparation